SHARE CERTIFICATE AND PAYMENT OF STAMP DUTY

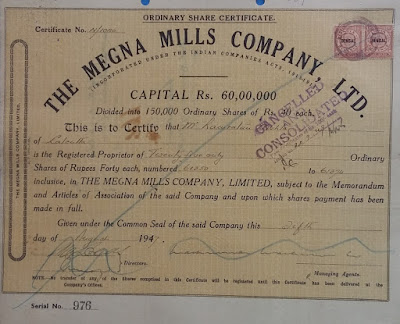

ISSUE OF SHARE CERTIFICATE AND PAYMENT OF STAMP DUTY SHARE For a Co. fund is really an important factor. One of the various ways of raising fund is from shares. Share is a part or holding of a share holder in share capital of Co. Share holder holds proportionate ownership in the Co. and to evident the same Co. should issue Share Certificate. SHARE CERTIFICATE A share certificate is a prima facia evidence of the fact that the person named therein is the owner of such number of shares as are specified therein. Issue of share certificate is mandatory for every Co. whether public , private or OPC. Share certificate is a certificate issued to shareholder in a certain format evidencing ownership of share holder. As per section 46 read with section 56 of COMPANIES ACT, 2013- Every company shall deliver (deliver means complete in all respect i.e. signed and stamp duty paid) the share certificate to its subs...